Methods) Used To Value Closing Inventory

This method consists of a. To calculate closing inventory by the gross profit method use these 3 steps.

What Is Inventory Valuation Importance Methods And Examples Zoho Inventory

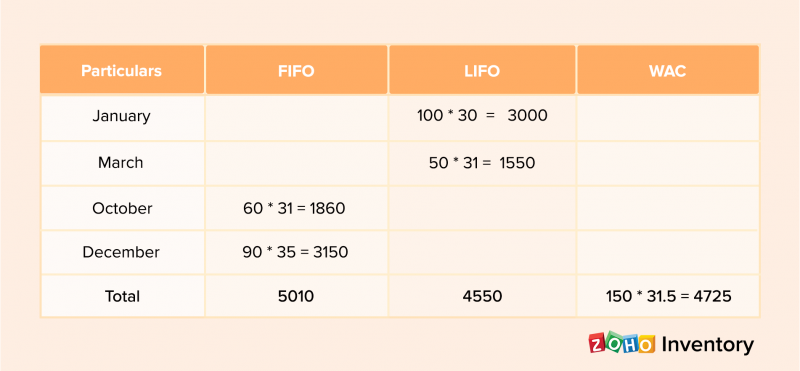

The three most widely used methods for inventory valuation are First-In First-Out FIFO Last-In First-Out LIFO Weighted Average Cost Inventory valuation method is.

Methods) used to value closing inventory. There are three common valuation methods for inventory. Closing inventory 3770. In management accounting there are various methods to value closing inventory and issues from stores.

Add the cost of beginning inventory plus the cost of purchases during the time. The three main inventory valuation methods are. Units purchased plus in opening.

The following are the most common methods used to determine ending inventory. The first-in-first-out FIFO method is one of the most common methods of inventory valuation as it is very simple and at the same time very easy to code. First-in first-out FIFO method This method of calculating ending inventory is based on.

The method you use for inventory valuation has a direct impact on all of these aspects. FIFO first in first out LIFO last in first out and weighted-average cost. Inventory valuation allows you to evaluate your Cost of Goods Sold COGS and ultimately your profitability.

Average costing method Under the average costing method the average price is used to calculate the closing value of stock-in-hand. To calculate closing inventory by the gross profit method uses the following steps. The Last-In First-Out LIFO method assumes that the last unit to arrive in inventory or more recent is sold first.

If you are looking to identify the value of Inventory of your business then WAC. Last-In First-Out LIFO method. Value of purchases plus opening stock 5000 3000 3300 11300.

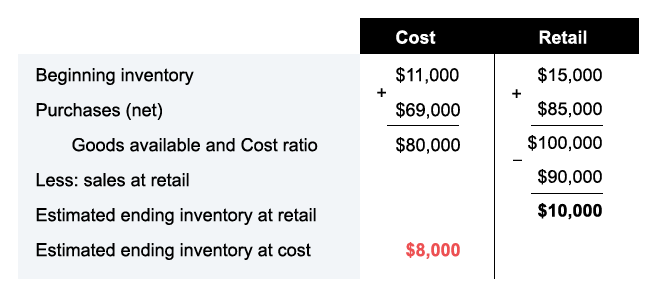

The most widely used methods for valuation are FIFO. LIFO is an inventory valuing method that assumes that the last items placed in inventory are the first sold during an accounting. 3 Methods To Calculate Closing Inventory 1 The Gross Profit Method.

When using the LIFO method the newest inventory is sold first with the older inventory sticking around on your shelves. So as the costs of manufacturing increase the. Both the LIFO method and the average methods will result in different values depending on whether a company uses the perpetual method or the periodic method.

The First-In First-Out FIFO method assumes that.

What Is Inventory Valuation Importance Methods And Examples Zoho Inventory

Methods Of Estimating Inventory Accountingcoach

Ending Inventory Formula Step By Step Calculation Examples

What Is Inflation Accounting Budgeting Tools Money Management Budgeting Money

Learn What Is The Best Inventory Valuation Method At Http Www Svtuition Org 2013 08 What Is Best I Accounting Student Accounting Education Learn Accounting

Gross Profit Method To Determine Ending Inventory Also Called Gross Margin Method Youtube

Inventory Closing And Adjustment With Microsoft Dynamics 365

5 Inventory Costing Methods For Effective Stock Valuation Lightspeed

What Is Inventory Control Definition Meaning Achievement Inventory Definitions Meant To Be

Fifo Method Accounting Double Entry Bookkeeping Cost Accounting Bookkeeping Business Accounting

Posting Komentar untuk "Methods) Used To Value Closing Inventory"