8 Methods Of Depreciation

It is recovered by adopting suitable method of charging depreciation and is absorbed into product cost on some equitable basis. Provision for depreciation Ac is not maintained.

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Accounting Classes

Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset.

8 methods of depreciation. 8 depreciation 1. It is provided on periodical basis. Useful lives or depreciation rates.

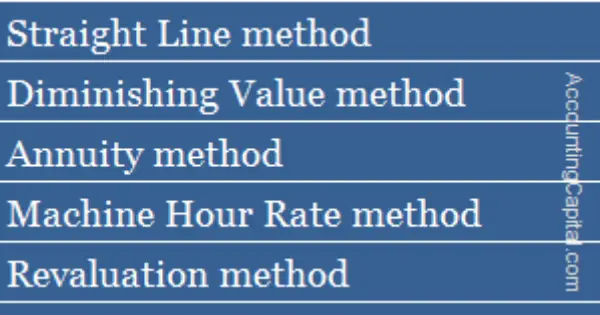

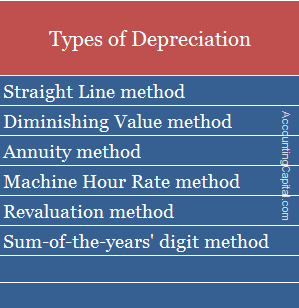

Methods of recording Depreciation. In addition to straight line depreciation there are also other methods of calculating depreciation Depreciation Methods The most common types of depreciation methods include straight-line double declining balance units of production and sum of years digits. It is the reduction in value of asset due to use or effluxion of time.

10 minutes to read. 8 methods of depreciation. Acquisitions through business combinations.

ZestLearn IGNOU_MBAIGNOU MBACourse. The distinguishing features of Depreciation and Obsolescence are given below. Depreciation Cheat Sheet httpsaccountingstuffcoshopIn this video youll learn how to use the Sum of the Years Digits Depreciation Method in Account.

DEFINITION OF DEPRECIATION Applies only to. There are eight methods of depreciation available in the default version of Business Central. Depreciation Methods for Fixed Assets.

Asset Disposal Ac is not opened. Provision for depreciation Ac is not maintained. There are two methods of recording depreciation.

Revaluation increases or decreases. FIXED ASSETS Assets acquired not for resale Help to earn revenue for more than 1 financial yearExamples - A printing machine in a printing company- A van in a courier service company. Gross carrying amount and accumulated depreciation and impairment losses.

Reversals of impairment losses. You can calculate straight-line depreciation by subtracting the assets salvage value from the original purchase price and then dividing it by the total number of years it is expected to be useful for the company. Provision for depreciation Ac is maintained.

Straight-line depreciation is the most simple and commonly used depreciation method. Depreciation methods used. Reconciliation of the carrying amount at the beginning and the end of the period showing.

8 methods of depreciation. Asset Disposal Ac is opened. MS 04 Accounting and Finance for ManagersBLOCK 2 - UNDERSTANDING FINANCIAL STATEMENTSUNIT 5 - CONSTRUCTION AND.

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting

What Is Depreciation Types Examples Quiz Accountingcapital

Depreciation Methods Economics Lessons Accounting Principles Financial Management

What Is Depreciation Types Examples Quiz Accountingcapital

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Methods Check Formula Factors Types Quickbooks

8 5 13 Methods Forms Of Depreciation Wikipedia Economics Lessons Power Of Attorney Form Budget Template

Posting Komentar untuk "8 Methods Of Depreciation"