9 Methods Of Depreciation

Calculate the After-Tax Salvage Value ATSV when the asset used for the production depreciates under the Modified Accelerated Cost Recovery System MACRS. In addition to straight line depreciation there are also other methods of calculating depreciation Depreciation Methods The most common types of depreciation methods include straight-line double declining balance units of production and sum of years digits.

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Earn Money Online Advertising Costs

Different methods of asset depreciation are used to more accurately reflect the depreciation and.

9 methods of depreciation. IFRS and US GAAP allow companies to choose between different methods of depreciation such as even allocation straight-line method depreciation based on usage production methods or an accelerated method double-declining balance. Depreciation is charged by debiting Depreciation Account and crediting the Asset Account. Methods- Straight Line Method Written Down Value Method Annuity Method 3.

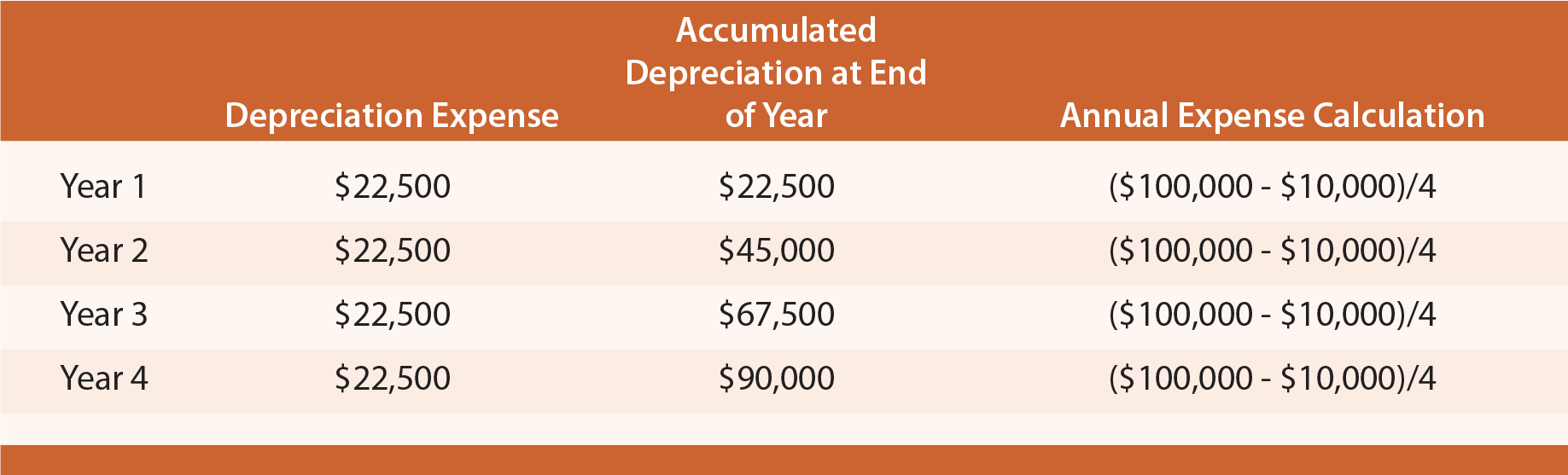

Compared to the other three methods straight line depreciation is by far the simplest. The method described above is called straight-line depreciation in which the amount of the deduction for depreciation is the same for each year of the life of the asset. Methods Of Depreciation 2.

The unit of production method is an atypical method that is unlike straight-line or other time-based methods for calculating depreciation. Provision for depreciation Ac is not maintained. Since this method of depreciation is based on physical output firms apply it in situations where usage rather than obsolescence leads to the demise of the asset.

Things You Should Know About Units of Production Method. Other Methods of Depreciation. Asset Disposal Ac is not opened.

There are two methods of recording depreciation. The mechanics of applying these methods do not differ between the two standards. Methods of recording Depreciation.

Depreciation Expense 15 - 3 x 2 60 04 million. Units-of-production output method The units-of-production depreciation method assigns an equal amount of depreciation to each unit of product manufactured or service rendered by an asset. Straight Line Method Simple widely used.

1 Direct Method No Provision for Depreciation Account is Maintained. Asset Disposal Ac is opened. Things wear out at different rates which calls for different methods of depreciation like the double declining balance method the sum of years method or the unit-of-production method.

So the depreciation expense for the processing plant is 04 million. The Depreciation is closed by transferring to Profit and Loss Account at the end of the year. You can calculate straight-line depreciation by subtracting the assets salvage value from the original purchase price and then dividing it by the total number of years it is expected to be useful for the company.

Straight-line depreciation is the most simple and commonly used depreciation method. Provision for depreciation Ac is not maintained. This method includes an accelerator so the asset depreciates more at the beginning of its useful life used with cars for example as a new car depreciates faster than an older one.

Methods of depreciation 1. Depreciation A reduction in the value of an asset over time due in particular to wear and tear. Provision for depreciation Ac is maintained.

There are two methods of recording depreciation in the books of accounts.

Macrs Depreciation Table Excel Excel Bookkeeping Basic

Macrs Depreciation Table Calculator The Complete Guide Economics Lessons Earn More Money Accounting And Finance

Depreciation Methods Check Formula Factors Types Quickbooks

Depreciation On Equipment Definition Calculation Examples

Depreciation Provisions Reserves Part I Single Quotes Quotes Method

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Accounting Simplified Com

Depreciation Methods Principlesofaccounting Com

Iasb Clarifies Depreciation And Amortisation International Accounting Intangible Asset Accounting

How To Calculate Ebitda Finance Lessons Cost Of Goods Sold Finance

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Accounting Classes

Posting Komentar untuk "9 Methods Of Depreciation"